Please like our Facebook page at

Please like our Facebook page at To watch the entire video, go to Course Summary:

Introduction to the principles and concepts of the audit as an attestation service offered by the accounting profession. Primary emphasis is placed on Generally Accepted Auditing Standards, the role of the CPA/auditor in evidence collection, analytical review procedures and reporting, the CPA/auditor's ethical and legal responsibilities, the role of the Securities and Exchange Commission as well as other constituencies. Audit testing, including statistical sampling, internal control issues, and audit programs are discussed. --

Description:

The accounts in the income statement are most affected by the sales and collection cycle (accounts such as sales, accounts receivable, cash in bank, cash discounts taken, sales returns and allowances, allowance for uncollectible accounts, and bad debt expense). Major functions include order entry, credit authorization, shipping, bulling, cash receipts, accounts receivable, and general ledger.

Audit evidence in management reports and data files can be found in pending order master files, credit check / approval files, price list master files, sales detail files (i.e. sales journal), sales analysis report, accounts receivable aged trial balance, cash receipts listing, and customer statements.

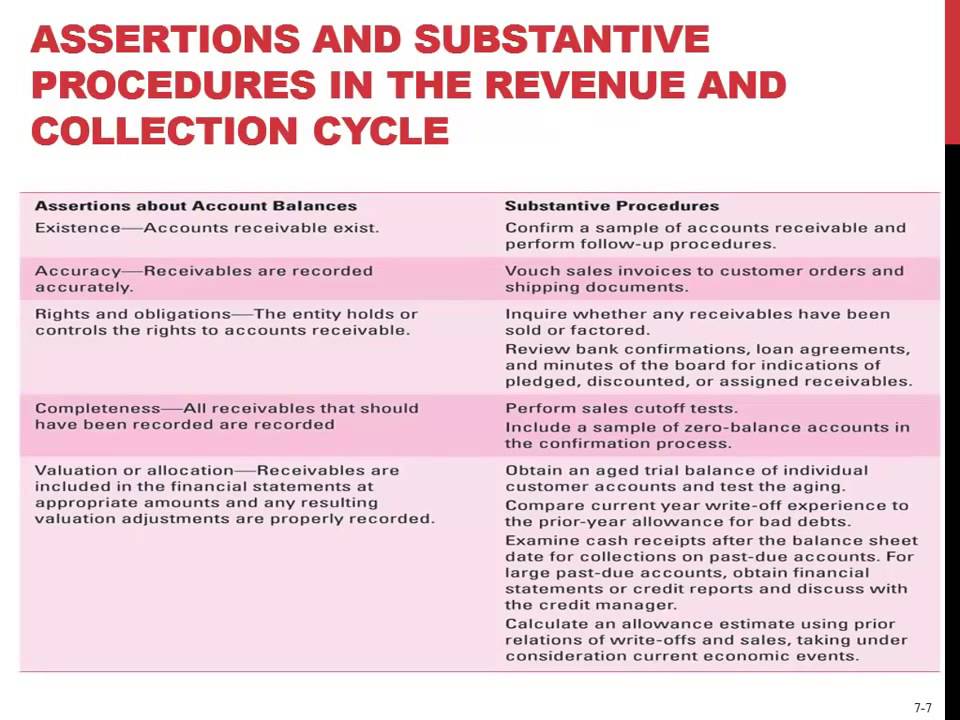

Assertions about classes of transactions and events for the period include occurrence, completeness, accuracy, cutoff, classification. Checking the existence of controls and checking whether the controls are adequate (testing controls) are also performed. Assertions about account balances are also performed, as well as substantive procedures on aforementioned assertions.

Key steps in designing an audit approach include identifying client business risks, studying the client's industry and external environment, and evaluating management's objectives and business processes affecting the financial statements. Preliminary analytical procedures can help in identifying potential risks. The auditor must also set the tolerable level of misstatement and assess inherent risk. Generally, one of the most significant accounts is accounts receivable. It is important to consider client business risk and the nature of the client's industry. Fraud risk should also be considered (relative to revenue recognition). Cut off errors should be taken note of, as well as allowance for doubtful accounts (which are judgment based).

The four inherent risk factors that may affect the revenue process are industry related factors, the complexity and contentiousness of revenue recognition issues, the difficulty of auditing transactions and account balances, and misstatements detected in prior audits. Inherent risks involve improper revenue recognition (cutoff, bill-and-hold, and channel stuffing), returns & allowances, and collectability of receivables.

Assessing control risk, specifically concerned with prevention or detection of embezzlement, cutoff errors, and allowance for doubtful accounts is also important. The auditor must identify key internal controls and deficiencies, associate controls and deficiencies with the objectives, and assess control risk for each objective.

Key control procedures include separation of duties (separate functions for recording, authorization, custody), authorization of transactions (write-offs, EDI transactions, credit checks prior to approval of sale, pricing), access to assets (shipping department, lock box account), adequate documents and records (pre-numbered sales orders, shipping documents [bills of lading], sales invoices, remittance advice), and independent checks on performances (accounts receivable subsidiary ledger to general ledger and monthly statement to customer).

Other controls include confirming no sales orders exist without customer orders, credit approval, restricted access to inventory, restricted access to terminals and invoices, all documentation in order to record sales, proper dating, invoices compared to BOLs and orders, and pending order files reviewed.

Auditors must also design and perform tests of controls and substantive tests of transactions.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

0 Comments